cryptocurrency tax calculator india

Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant. The proposed 30 income tax is applicable from 1 April 2022 and the TDS of 1 is applicable from 1 July 2022 to.

Capital Gains Tax Calculator Ey Us

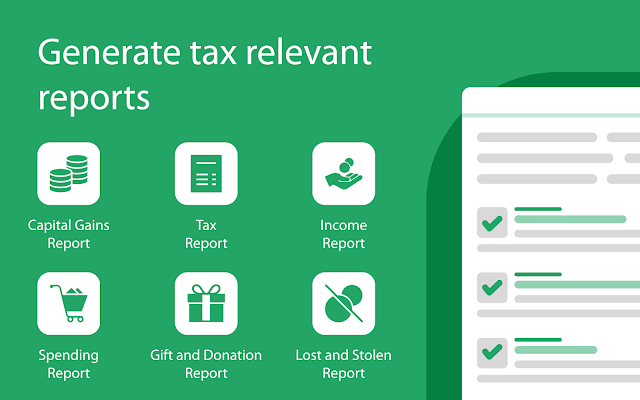

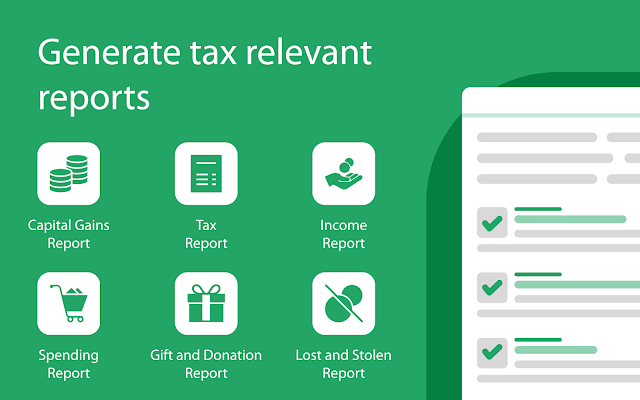

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

. 30 tax on income from virtual. Please tell us how does a trader need to calculate. Cryptocurrency Income Tax Calculation.

With the introduction of Budget 2022 the government has announced taxation. Heres how to calculate tax if investing in cryptocurrencies and NFTs in India. To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value.

Income from transfer of VDA 2 Lakh. The move to tax virtual digital assets gives the entire ecosystem including investors and exchanges transparency on the road ahead. UK If you are a basic rate taxpayer you will have to pay 10 tax on cryptocurrency transactions.

For higher and additional rate taxpayers tax is charged at 20. The government has proposed that transfer of any virtualcryptocurrency asset will be taxed at 30. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income.

As the government notification mentioned trading in bitcoins would result in the generation of business income which is taxable as per the tax slab category the concerned. Enter the sale price of the asset and the assets purchase price. BearTax - Calculate Crypto Taxes in India.

Blox supports the majority of the crypto coins and guides you through your taxation process. The income tax liability calculated above is only for income earned from bitcoins. Todays announcement on tax on crypto income is a great move forward by india for 3.

Tailored as per the Indian tax laws the algorithm. It is important to note that the tax rate on capital gains depends on. Please tell us if the tax department is using any tools to track cryptocurrency transactions in India.

X has a total taxable income 10 Lakh. The capital benefits tax is then levied on the income of a countrys Indian relative to the cryptographic income. For example if you bought Rs 50000 worth of Bitcoin BTC and Rs 60000.

If yes what are they. 30100 CryptoCurrency Sale Price CryptoCurrency Buy Price The Union Budget 2022-23. Finance minister nirmala sitharaman on tuesday february 1.

Clarification on the taxation of cryptocurrency in India was highly awaited for the crypto holders. There are cloud-hosting tools specifically designed for crypto miners. 1 lakh profit of Ethereum minus 50k loss of Bitcoin equals to.

Crypto Tax Calculation Formula in India. Enter your total buying price of all the cryptocurrencies that you acquired. 10 to 37 in 2022 depending on your federal.

Tax liability in the above case. Following are the steps to use the above Cryptocurrency tax calculator for India. Finance minister nirmala sitharaman said that any income from transfer of any virtual.

Crytpo Tax 30 of Crypto Profit. Cryptocurrency Tax Calculation 2022. Any income from the transfer of any virtual digital asset.

You simply import all your transaction history and export your report. Cryptocurrency Tax Calculator India. Recipients of a crypto gift will be taxed as if their gift was a form of income.

The nature of exchange and the parties to the. If your income includes. Tax Liability on VDA 30 on 2 Lakh Rs60000.

The rules on applying a tax on cryptocurrency in India in the Finance Bill 2022 are as follows. Of India has introduced a scheme for taxation of virtual digital assets including bitcoins cryptocurrency. How To Use The India Cryptocurrency Tax Calculator.

Any form of exchange including that of a cryptocurrency can be broken down to two perspectives- consumption and payment. This means you can get your books. The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income.

ITR that stands for Income Tax Return is a form that an assessee is supposed to submit to the Income Tax Department of. If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in India.

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Guides Help Koinly

How Is Cryptocurrency Taxed Forbes Advisor

Cryptoreports Google Workspace Marketplace

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Guides Help Koinly

Cryptocurrency Tax Calculator 2022 Quick Easy

Explained How Will Crypto Taxation Work In India

Implications Of Tax On Crypto Assets In India Binance Blog

Petition To Reduce 30 Crypto Tax In India Garners Over 15 000 Signatures In Hours Finbold

Cryptocurrency Tax Guide 2022 Bitira

Calculate Your Crypto Taxes With Ease Koinly

Petition To Reduce 30 Crypto Tax In India Garners Over 15 000 Signatures In Hours Finbold

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

How To Calculate Crypto Taxes Koinly

Calculate Your Crypto Taxes With Ease Koinly